Table of Contents

- Introduction: The Rumble Phenomenon

- Factor 1: The Platform Wars and Rumble’s Niche

- Factor 2: Financial Performance & User Metrics

- Factor 3: The Volatile Dance of Short Interest

- Factor 4: High-Profile Partnerships & Content Deals

- Factor 5: Broader Market Sentiment & Tech Valuations

- Factor 6: Regulatory Clouds and Legal Battles

- Factor 7: The Long-Term Vision vs. Quarterly Noise

- Conclusion: Navigating the Future of Rumble Stock

1. Introduction: The Rumble Phenomenon

The Rumble Stock Price has generated the most significant polarizing debate in the public market. Some see the stock as a gamble on a new digital free-speech platform that threatens established tech monopolies. Others view it as a meme stock unrooted in any reasonable fundamental analysis. It is essential to analyze the fundamentals that drive a stock’s price to make a wise investment decision. To help investors make informed decisions, the rest of this article will set aside the hype and analyze the seven most important things investors should focus on.

Factor 1: The Platform Wars and Rumble’s Niche

You cannot talk about Rumble Stock Price without first discussing the core battlefield. Rumble Inc. did not just try to become “another video platform.” Their target was YouTube as a “principled alternative,” pursuing a minimalist content-moderation model. This goal shaped their unique audience and creator ecosystem.

The “Free Speech” Premium: A portion of Rumble’s valuation debt and primary valuation metrics. When major platforms’ censorship becomes a hot topic, Rumble chat rooms become active, and the Rumble Stock Price rises. This is a portrayal of free speech as a national geo-political and cultural sentiment.

The Challenge of Scale: Niche is a core strength. Rumble Stock Price. The Challenge. Can it “attract mainstream content and advertisers” without alienating the core audience? Balancing the act of removing censorship is dire, and the company’s goals will shift the Rumble Stock Price.

Factor 2: Financial Performance & User Metrics

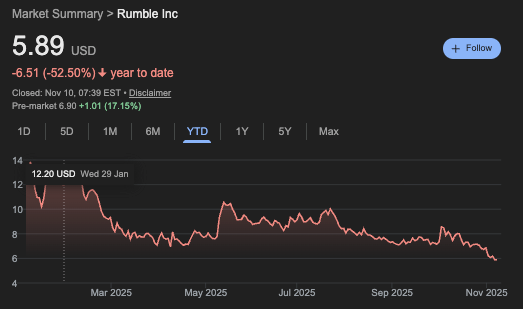

Ideological or headline-driven aside, the quarterly reports tell the story, and the Rumble Stock Price reacts to them, sometimes violently.

The Revenue Growth: Top-line growth from advertising revenue, subscriptions, and cloud services. The growth is leading, stagnant, or declining. This answer fuels Rumble Stock Price growth.

User Engagement: Total hours watched, Monthly Active Users, and uploads serve as bloodlines to Rumble. Inactive user metrics can put downward pressure on Rumble’s Stock Price. Even if revenue is rising, the market wants to see user engagement and scalability.

The Path to Profitability: Rumble has invested heavily in content and infrastructure. The ultimate question is, when should the Rumble Stock Price project sustain profitability? Sustained quarterly losses can be forgiven when you’re growing. However, no one stays forgiven forever.

Factor 3: The Volatile Dance of Short Interest

Rumble is one of the most short-sold stocks. The Rumble Stock Price has an unusual, often volatile reaction.

The Squeeze Catalyst: The higher the short interest, the more investors believe the Rumble Stock Price will drop. Positive news can trigger a short squeeze as short sellers are forced to buy stocks to cover their positions. Rumble’s Stock Price has experienced the most volatility around both positive and negative news events.

A Double-Edged sword: On the negative side, bad news can trigger a “race for the exits,” piling on shorts and increasing selling pressure on Rumble Stock Price Shorts. In Rumble’s case, this makes monitoring short interest ratios more than academic; it relates directly to the potential instability of the Rumble Stock Price.

Fifth Factor – Strategic Partnerships and Content Deals

To enhance Rumble’s credibility and attract more potential users, Rumble has entered into multiple contracts. Each contract signed is a positive development and contributes to the Rumble Stock Price.

The Barstool Effect. A major pioneer partnership was Rumble’s contract with Barstool Sports, the digital media company owned by Dave Portnoy. Such significant partnerships assure a positive flow of content and viewers, and potential Rumble Stock Price increases, or optimistic projections.

Political Commentary Exodus. Prominent figures who feel they are censored, such as Dan Bongino, attract loyal followings. Some investors have a positive outlook for Rumble Stock Price based on the performance of these exclusive content wagers. A prominent, high-traffic creator can improve investor confidence, while low-traffic expectations can undermine it.

Fifth Factor – Overall Market Sentiment and Tech Valuations

The Rumble Stock Price is not constantly vacuum trading. The broader market’s flow heavily influences it.

Risk On vs. Risk Off: Rumble stock generally does well in a risk-on, risk-on environment, when investors pursue high-growth, high-risk investments. In a risk-off environment, money moves out of high-risk assets like Rumble into lower-risk assets, and regardless of company-specific news, this pushes down the Rumble Stock Price.

Interest Rates and Tech Valuations: Rumble, like other growth tech stocks, is valued based on interest rates. Higher interest rates mean future earnings in present value are lower, and this might adversely impact Rumble’s Stock Price in

Factor 6: Lack of Certainty

The combination of tech, media, and politics creates significant uncertainty.

Content Liability Debates: Ongoing debates over content liability could threaten a company like Rumble. If new legislation increases a company’s legal liabilities, it could negatively affect the Rumble Stock Price.

Antitrust and Interoperability: While these laws are primarily targeted at major companies, broader Antitrust legislation aims to cover the entire digital environment. On the other side of the coin, some laws require larger platforms to be more interoperable, and that can be a fringe benefit for Rumble. Rumble Stock Price is a measure of the perceived regulatory risk for other platforms.

Investment Strategy: Long-term Vision versus Short-term Noise

Lastly, there is a conflict between short-term and long-term investors over the Rumble Stock Price.

Long-term Predicted Rumble Price Based on Cloud Infrastructure and Payment Systems: Management envisions the bigger picture beyond just video capture technology. They plan on creating a fully integrated, neutral cloud and payment system. Future Rumble Stock Prices will be based on the success of this gambit. Short-term traders do not care. Long-term investors care a lot.

Ecosystem Interconnectivity: The video, cloud, ad, and subscription components will be interdependent. The ecosystem is expected to create a rising Rumble Stock Price. The ecosystem will create more reliable revenue streams with less volatility.

Final Thoughts: The Future of Rumble Stock

Predicting the Rumble Stock Price is complicated, as it is influenced by controversy, speculation, and lofty aspirations. By knowing the seven factors of the stock: platform, financials, short interest, partnerships, market sentiment, and regulations, investors can see beyond the headlines and focus on their long-term vision.

The right question isn’t ‘What will the Rumble Stock Price do tomorrow?’ but rather ‘What factors are strengthening or weakening?’ By establishing this framework, you will be able to make reasoned decisions about whether you consider Rumble a volatile trading vehicle or a genuine, albeit risky, long-term investment in an alternative digital future. As the Rumble Stock Price continues its rumble, investors will be able to distinguish between the noise and the signal.

You may also read routertool.